Bitcoin has really gone main stream over the past few months, with everyone talking about the price movement on bitcoin, both on the big bull runs, and the major corrections. One thing is certain with bitcoin, and that is that there is going to be a lot of volatility in the coming years as this new technology gains further main stream appeal. The other certainty is the strong feelings people have about bitcoin one way or another. If you found this page I’m sure you either really believe in cryptocurrency and want to bet on bitcoin to increase in price, or else you think bitcoin is a bubble and want to capitalize on betting that bitcoin move back towards 0 by shorting it.

I’m not here to tell you whether bitcoin will increase or decrease in price. This price is simply a how to guide to show you how to bet on bitcoin’s price movement one way or the other.

The easiest way to bet on bitcoins price movement is trading futures contracts. You can purchase long or short contracts for just $1 each at Bitmex.com, the first and best best Bitcoin Mercantile Exchange. Bitmex is a highly trusted and respected futures exchange that is frequently used by the bitcoin trading community.

Below I will provide a quick 4 step guide to buying bitcoin futures contracts at Bitmex, which is essentially betting on bitcoins price. This is a very basic guide for beginners that simply explains how to use the exchange. I suggest using the Bitmex Testnet to try out a few trades before actually using real money to bet on bitcoin. I also suggest starting out with low leverage until you get the hang of things.

How To Bet On Bitcoin Price Movement – Futures Trading Online

Follow these 5 steps to place bets on bitcoins price through futures contracts purchased at Bitmex.com.

Step 1. Open a Bitmex.com Account

Click the above link and fill out the registration form to open an account at Bitmex. By signing up through our link you will receive a 10% discount on all trading fees for the first 6 months of your account.

After verifying your email you will be able to log in to your new account.

Step 2. Deposit Bitcoin

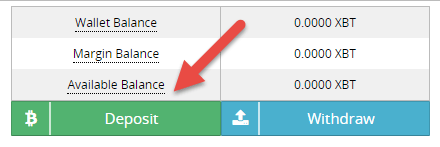

Next you will need to fund your account with bitcoin in order to start purchasing long or short contracts on bitcoin. To deposit click on ‘Account’ in the top navigation bar once you are logged in to Bitmex.

Click the green ‘Deposit’ button and you will be shown a bitcoin address where you can send some funds.

**Bitcoin is the only currency accepted at Bitmex. If you don’t have bitcoin, you will need to purchase some before continuing with this guide.

Step 3. Buy or Sell Contracts (Long or Short Bitcoin)

Now that you have funds in your account, you’re ready to buy a long or short contract. Buying a long contract is a bet on the price of bitcoin increasing, while a short contract is a bet on the price of bitcoin decreasing.

Here’s an example of buying a long contract, which is a bet on bitcoin going up.

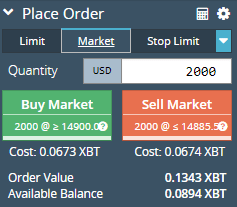

First you need to enter the quantity of contracts you wish to purchase. These contracts are valued at $1 USD each. In this example, I’m buying 2000 contracts at a a market price of bitcoin of $14900. The cost of the position is 0.0673 bitcoin, but the order value is 0.1343 bitcoin because I’m using 2x leverage.

After selecting ‘Buy Market’ you will be shown an order confirmation where you can change your leverage. The more leverage you use the lower your cost for the specified order value, but the higher your liquidation price will be. If the bitcoin price drops lower than the liquidation price then your position will be liquidated and you will lose the entire cost of your order.

Step 4. Close Position

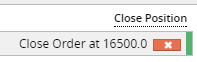

Now that your position is open you will need to close it at some point to realise your profit or loss. You can either select a limit price that you wish to close your position at, or close the position at the market price. You can see these options on the right side of your position purchase.

In the above example I have set a close position of 16500. This means if the price of bitcoin reaches $16500 my long bitcoin position will close automatically. Here’s a screenshot of how that would look:

Here is a look at the liquidation price of my order:

So now, if I don’t touch this position again, it will close the next time bitcoin either reaches 16500 or falls to 9966.5. If it hits $16,500 first I would realize a profit, but if it hit my liquidation price I would lose the entire cost of the contract.

So there you have it, four steps to betting on the price of bitcoin at Bitmex.com. This is a very basic tutorial that simply shows how to use Bitmex at it’s most basic level. If you’re planning to bet big amounts of bitcoin then I strongly suggest using the Testnet first and also reading some more in depth articles such as the trading overview at the Bitmex website.

Do you think you’re ready to bet on bitcoin? Click here to visit Bitmex.com and get started.

Tagged With : bitcoin • bitcoin betting • bitcoin futures • bitcoin price